Global Single-Cell Genome Sequencing Market By Product (Instruments and Reagents), By Technology (NGS, qPCR, PCR, Microarray, and MDA), By Workflow (Isolation, Genomic analysis, and Others), By Disease Area (Cancer, Prenatal diagnosis, and Others), By Application (CTCs, Differentiation/ reprogramming, and Others), By End-use (Academic & Research Laboratories, Clinics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 58591

- Number of Pages: 292

- Format:

- keyboard_arrow_up

Single-Cell Genome Sequencing Market Overview:

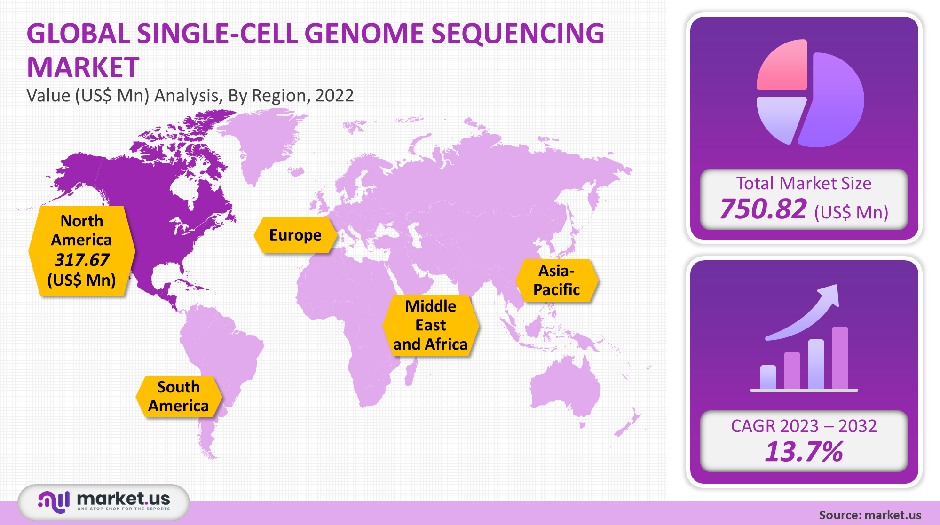

In 2021, the market for single-cell genomic sequencing (SCGS), was valued at USD 750.82 million. It is predicted to experience a 13.7% CAGR over the forecast period.

Global Single-Cell Genome Sequencing Market

Product Analysis

The largest revenue share was held by instruments in 2021. The development and implementation of technologically advanced instruments and solutions will drive future growth. C1 system can be used to prepare templates for DNA sequencing and mRNA sequencing.

This system allows for simultaneous isolation, lysis, and staining as well as neutralization. It provides unbiased amplifying and allows genomes to properly be represented with higher consistency and reproducibility.

This segment will remain dominant until 2032 and grow at the highest CAGR in the forecast period.

Technology Analysis

NGS is expected to be the fastest-growing segment of technology in the market. The segment’s rapid growth can be attributed to extensive R&D and a variety of applications in the field of cancer-related research. Genome sequencing is the process of analyzing and sequencing DNA. Researchers have created combinatorial indexed DNA sequencing tools that are useful in clinics for guiding targeted therapies and noninvasive monitoring.

A microarray allows the quantification and analysis of thousands of genes. This is done by combining biological samples with an array that contains thousands of synthetic Oligonucleotide probes. The use of microarray has declined since the introduction of NGS technology. Illumina Inc. is just one company that offers advanced microarrays for SCG applications.

MDA, or multiple displacement amplification, is the most common method of whole-genome amplification prior to SCGS. Numerous studies have proven the principle of WGA and MDA. This simple method allows researchers simultaneously to detect copy number variations and single nucleotide polymorphisms in individual cells. It also significantly improves amplification accuracy, uniformity, and consistency.

Workflow Analysis

Recent advances have provided new opportunities for quantification of mutation rates, identification of rare cell types, and characterization of intra-tumor cell heterogeneity to guide diagnosis and treatment. SCG analysis can also be used to reconstruct tissues in multicellular organisms.

Fluidigm, one of the most prominent players in SCGS-based technology and techniques, is also a leading player. Fluidigm has developed complex microfluidics platforms and used them for single-cell-oriented studies. In addition, Illumina Inc., 10x Genomics, and other entities are actively involved in the development of advanced genomic analysis platforms.

The development of microfluidic devices has also led to the integration of steps involved with sequencing sample preparation and library generation, for up to 96 samples. These systems can be used to reduce DNA input requirements by up to 100 folds and improve data handling.

The integration of integrated sample preparation systems, which are based upon lab-on-chip techniques, can overcome technical obstacles and allow for greater use of genomics across a variety of translational as well as basic investigational applications.

Disease Area Analysis

The single-cell genome sequencing market was dominated by cancer in 2021. There are lucrative growth opportunities due to the rising incidence of colorectal, prostate, and breast cancers. WHO reports that 8.8 million people died from various types of cancers in 2015.

Other organizations, such as the American Cancer Society & Breast Cancer Organization, are expected to increase growth. For example, the American Cancer Society approved funding for USD 39 million in cancer research and training. These funds are expected to enable technological advances in the field of cancer diagnosis and research.

Application Analysis

The market’s largest share in 2021 was held by circulating cells. Multiple studies also showed that cell-free DNA has a good representation in the early stages of lung cancer and gastric cancer. It identifies biomarkers related to the tumor and allows for molecular pathology to be determined by sequencing cell-free DNA with tumor origin.

These can be used for genomic profiling to identify sequence mutations and copies in disseminated cancer cells. The market is expected to grow due to such studies. It can also help in diagnosing the condition.

End-Use Analysis

The forecast period will see the highest revenue contribution from academic and research labs. The rising number of genomic centers, as well as ongoing research in this field, can account for the dominance. Many genomic centers are actively involved in studying single-cell genome, transcriptome, epigenome, and progression of the disease. They also offer high-throughput sequence library preparation and isolation services.

The funding is provided by the government as well as private companies. Over the forecast period, there will be an increase in the market due to the existence of many research institutions, especially in the developed world. In the next few years, single-cell genome sequencing will be a hot commodity due to the increased usage of sequencing kits for understanding the morphology of multiple genes and their function in different chronic conditions.

Key Market Segmentation

Product

- Instruments

- Reagents

Technology

- NGS

- qPCR

- PCR

- Microarray

- MDA

Workflow

- Isolation

- Genomic analysis

- Sample preparation

Disease Area

- Cancer

- Prenatal diagnosis

- Immunology

- Neurobiology

- Microbiology

- Others

Application

- CTCs

- Differentiation/ reprogramming

- Subpopulation characterization

- Genomic variation

- Others

End-use

- Academic & Research Laboratories

- Clinics

- Biotechnology & biopharmaceutical companies

- Others

Market Dynamics

Market growth can be attributed to several key trends, including increased R&D and an increasing incidence of cancer and severe chronic and severe immune system disorders. Companies are also focusing more on product development. Over the forecast period, the market is expected to benefit from government policies that will support it.

Technological advances in single-cell genome sequencing play an important role in the growth of the market. Bio-Rad Laboratories Inc., in collaboration with Illumina Inc., has developed an innovative workflow to perform SCGS analysis. They have just announced the launch of SCGS. These platforms are technologically advanced and offer intuitive analysis solutions. They also come at a low cost.

The market’s progress will be supported by government policies over the forecast period. Market growth is expected to be driven by the increasing number of genomics research centers. Numerous established centers are currently working on accelerating advances through collaborative activities.

Qiagen Inc. and Illumina Inc. are some of the participants who are creating and manufacturing NGS-based platforms. These tools include SCGS-related bioinformatics, sampling, and sequencing. NGS platform allows simultaneous sequencing of multiple targeted genomic regions from different samples in order to detect concomitant variants. This is a great way to achieve maximum tumor genomic assessment.

Harvard University investigators have recently developed new approaches like Drop & Drop Seq. These methods allow for the isolation of thousands upon thousands of cells, and the preparation of sequencing. Both commercial and academic researchers continue to push the boundaries and shape the future of the genomics industry.

Regional Analysis

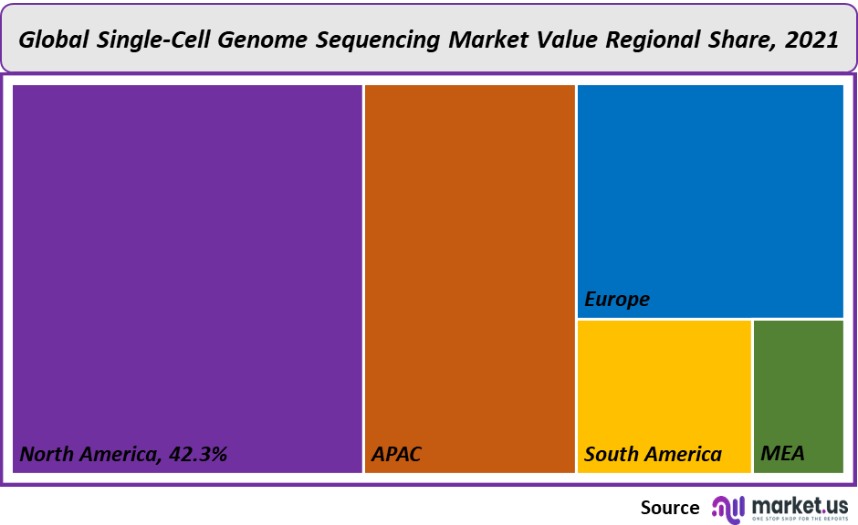

North America dominated the market in 2021, with the U.S. leading revenue contributor. Market in North America accounted for a leading share of 42.31% in 2021. This region is dominated by rising cases of cancer, neuropsychiatric disorders, and immunological disorders. These factors are complemented by technological advancements made possible through entities in the region.

Due to increased genomics research, the market will rise over the projection period. For example, a study of phage sequences, and virulence factors in microbial communities from an environmental sample used ultra-high-throughput microfluidic droplet barcoding, and antibiotic resistance genes. This was done by University of California researchers.

Asia Pacific is expected to be the fastest-growing segment due to the increasing R&D investment in the area. A good administration support system and cooperation between entities in Asian countries will be key to the success of the regional market.

Numerous studies are being done on multiple displacement amplification in order to enhance genome amplification. This method, according to Waseda University researchers, allows whole genome amplification of both single and multiple bacterial cells. These activities are expected to increase market growth during the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

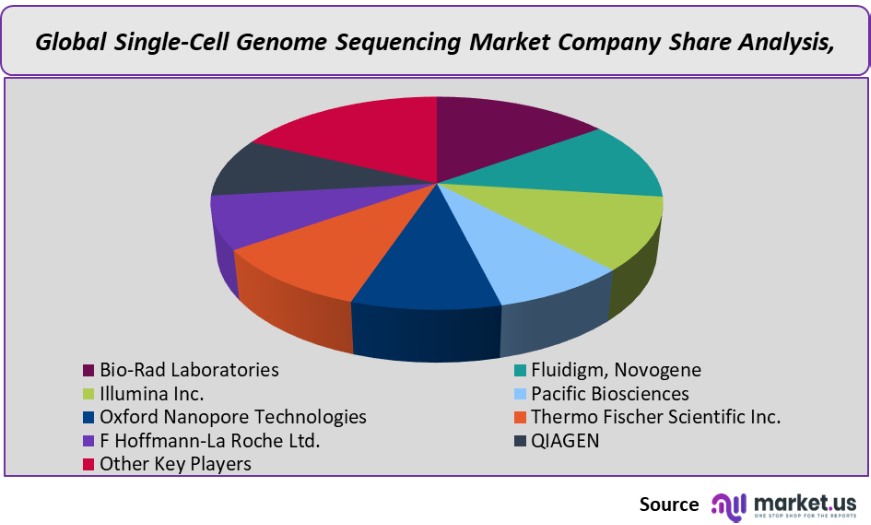

Market Share Analysis

To increase their product portfolios, market leaders are now forming partnerships with key players. In order to grow their business and keep a competitive edge on the market, companies are increasing their R&D and distribution capabilities.

Illumina Inc., along with Bio-Rad, launched a single-cell genome sequencing solution in January 2017. This will allow researchers to examine the role of individual cell organelles in disease progression, therapeutic response, and tissue function.

Qiagen Inc. announced in February 2016 its collaboration with 10x Genomics Inc. Both entities reached a development and marketing agreement to create integrated workflow solutions for the market.

Key Market Players

- Bio-Rad Laboratories

- Fluidigm, Novogene

- Illumina Inc.

- Pacific Biosciences

- Oxford Nanopore Technologies

- Thermo Fischer Scientific Inc.

- F Hoffmann-La Roche Ltd.

- QIAGEN

- Other Key Players

For the Single-Cell Genome Sequencing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Single-Cell Genome Sequencing market?A: The Single-Cell Genome Sequencing market size is projected to generate revenues of approx. US$ 750.82 million (2023-2032).

Q: What is the projected CAGR at which the Single-Cell Genome Sequencing market is expected to grow at?A: The Single-Cell Genome Sequencing market is expected to grow at a CAGR of 13.7% (2023-2032).

Q: List the segments encompassed in this report on the Single-Cell Genome Sequencing market?A: Market.US has segmented the Single-Cell Genome Sequencing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Instruments and Reagents. By Technology, the market has been further divided into NGS, qPCR, PCR, Microarray, and MDA. By Workflow, market has been segmented into Isolation, Genomic analysis, and Sample preparation. By Disease Area, the market has been further divided into Cancer, Prenatal diagnosis, Immunology, Neurobiology, Microbiology, and Others. By Application, market has been segmented into CTCs, Differentiation/ reprogramming, Subpopulation characterization, Genomic variation, and Others. By End-use, the market has been further divided into Academic & Research Laboratories, Clinics, Biotechnology & biopharmaceutical companies, and Others.

Q: List the key industry players of the Single-Cell Genome Sequencing market?A: Bio-Rad Laboratories, Fluidigm, Novogene, Illumina Inc., Pacific Biosciences, Oxford Nanopore Technologies, Thermo Fischer Scientific Inc., F Hoffmann-La Roche Ltd., QIAGEN, and Other Key Players engaged in the Single-Cell Genome Sequencing market.

Q: Which region is more appealing for vendors employed in the Single-Cell Genome Sequencing market?A: North America accounted for the highest revenue share of 42.31%. Therefore, the Single-Cell Genome Sequencing Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Single-Cell Genome Sequencing?A: U.S., Canada, U.K., Germany, Japan, China, Brazil, South Africa, are key areas of operation for Single-Cell Genome Sequencing Market.

Q: Which segment accounts for the greatest market share in the Single-Cell Genome Sequencing industry?A: With respect to the Single-Cell Genome Sequencing industry, vendors can expect to leverage greater prospective business opportunities through the instruments segment, as this area of interest accounts for the largest market share.

![Single-Cell Genome Sequencing Market Single-Cell Genome Sequencing Market]() Single-Cell Genome Sequencing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Single-Cell Genome Sequencing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Bio-Rad Laboratories, Inc. Company Profile

- Fluidigm, Novogene

- Illumina Inc.

- Pacific Biosciences

- Oxford Nanopore Technologies

- Thermo Fischer Scientific Inc.

- F Hoffmann-La Roche Ltd.

- QIAGEN NV Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |