Global Smart Agriculture Market By Agriculture Type (Precision farming, Smart greenhouse, and Other Agriculture Types), By Application (Precision farming application, Livestock monitoring application, and Smart greenhouse application), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 16886

- Number of Pages: 387

- Format:

- keyboard_arrow_up

Smart Agriculture Market Overview:

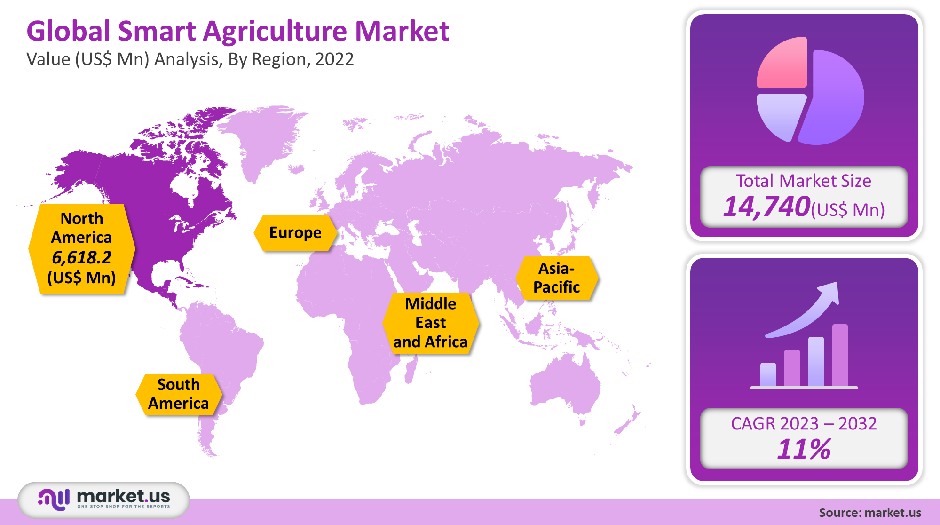

The global smart agriculture market was valued at USD 14,740 million in 2021. It is expected to grow at a compound annual growth rate of 11% between 2023 and 2032.

The key drivers of demand for smart agriculture are increasing automation in commercial greenhouses and the growing use of controlled environment agriculture (CEA) in greenhouses to increase yield and maintain optimal growing conditions.

Commercial greenhouses have been developed because of the benefits that greenhouses can offer to grow plants. Because LED grows lights can be easily integrated into a CEA setup, cultivators have moved away from traditional lighting systems. They are a great option for indoor farming despite the high cost of LED grow lights. However, their long-term energy savings make them an attractive choice.

Global Smart Agriculture Market Scope:

Agriculture Type analysis

Based on the type of agriculture, in 2021, the livestock monitoring segment represented 21.8% of the global smart farming market. The smart farming market can be further segmented into smart greenhouse, precision farming, and other segments. Other segments include fish farming and horticulture.

Precision livestock monitoring allows for real-time monitoring and analysis of the health, production, welfare, and performance of livestock in order to maximize yields. Market players have been urged to concentrate on new product launches and significant cost savings as a result of the growing size and technological advances in precision livestock monitoring.

Vertical farming is included in the market forecasts and estimates for the smart greenhouse segment. Smart greenhouses allow farmers to grow crops without the need for human intervention. The smart greenhouse continuously monitors climatic conditions like soil moisture, temperature, and humidity and triggers an automatic action if there is any variation.

Smart farming is a holistic approach to farming management that uses IoT and information communication technology. It aims to preserve resources and maximize yields. Smart farming uses real-time data to monitor the soil, air, and crops. Smart farming is designed to maximize the yield and profitability of the farm while protecting the environment.

Application Analysis

The market share for yield monitoring was 44.2% in 2021. This can be attributed to the increasing demand for crop monitoring and the reduction of overall wastage through the timely provision of water and minerals. Agriculture type can be used to manage irrigation, yield monitoring, and crop scouting. It also includes field mapping, weather tracking, and forecasting, inventory management, farm labor management, and crop scouting. Forecasting and weather monitoring will see the greatest growth over the forecast period.

The growing water scarcity and rising environmental consciousness of consumers have prompted the need for agricultural management practices to be modified in order to conserve natural resources like soil and water. The segment of irrigation management is expected to grow significantly over the forecast period. Precision irrigation is a combination solution that matches irrigation inputs with yields for each field.

Smart greenhouses can be used for water and fertilizer management, HVAC management, yield monitoring, as well as other functions. As more greenhouse farms use it, the HVAC management market is expected to grow significantly. HVAC management is in high demand because it is necessary to maintain different temperatures and humidity levels for aquaculture and hydroponic grow areas.

Кеу Маrkеt Ѕеgmеntѕ

By Agriculture Type

- Precision farming

- Livestock monitoring

- Smart greenhouse

- Other Agriculture Types

By Application

- Precision farming application

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Others

- Livestock monitoring application

- Milk harvesting

- Breeding management

- Feeding management

- Others

- Smart greenhouse application

- Water & fertilizer management

- HVAC management

- Others

Market Dynamics:

The market is driven by livestock biometrics. These include RFID, biometrics, and GPS. This allows cultivators to automatically get information about their livestock in real-time. Infrastructural sensors can be used to monitor material conditions and vibrations within buildings, factories, bridges, and farms. Infrastructural sensors, when paired with an intelligent network, provide real-time information to the maintenance crew. Agro robots can also be used to automate agricultural processes such as soil maintenance and weeding, fruit picking harvesting, planting, plowing, and irrigation, among other things.

Farmers are increasingly adopting more efficient and smarter agriculture technologies in order to sustain their profits. They also need to be able to supply sufficient quantities of high-quality products to the smart agricultural market. Mobile technology allows for the provision of innovative services and applications across the entire agricultural value chain.

Machine-to-Machine applications (M2M) are especially suited to the agricultural sector. They enable farmers to monitor equipment and assess the impact on production. M2M is an integral component of IoT. It describes the coordination between multiple devices, appliances, and machines connected to each other via multiple networks.

The COVID-19 pandemic caused widespread disruption in the global supply chain, leading to food shortages and inflation. It is necessary to take the necessary steps to improve the food supply chain and be prepared for any future crises. It is important to be able to conduct agricultural operations remotely, as evidenced by the ongoing pandemic. Future market growth will be driven by smart agricultural practices that allow farmers to recover their losses in a shorter time frame.

Regional Analysis

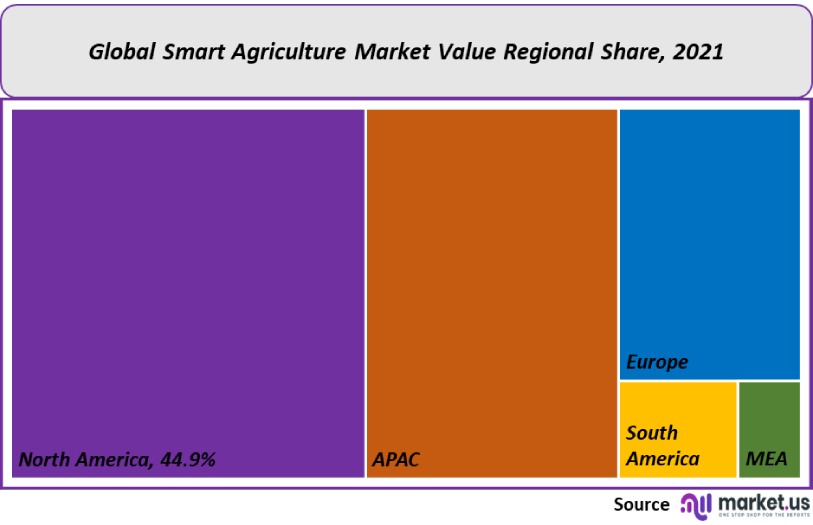

North America was the dominant market for smart agriculture in the world, with a 44.9% market share in 2021. From 2023 to 2032, it is expected to grow at 9.1%. The forecast period will see a rise in North American regional demand due to increased government initiatives and regulations that aim to improve the region’s agriculture industry.

The North America Climate Smart Agriculture Alliance has been formed by a number of agricultural organizations. It is a platform that educates and equips cultivators to increase their agricultural productivity. North American governments are providing subsidies to encourage smart irrigation because of rising water conservation concerns. California, for example, has offered a rebate on smart controllers.

The Asia Pacific will see the greatest growth over the forecast period. Although smart farming is in its infancy in this region, growing government support and increased awareness among growers are expected to boost regional demand over the forecast period. In Japan, for example, the ministry has provided funds to support precision agriculture. Each country’s farmers’ associations and community-based organizations play an important role in the promotion of sustainable agriculture.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

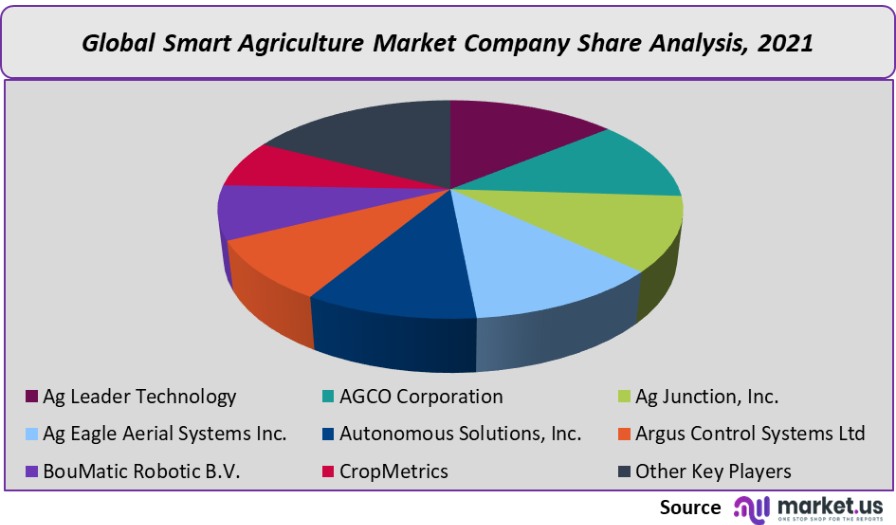

In their quest to increase their product range, industry players engage in many inorganic growth strategies such as frequent mergers or acquisitions. Ag Leader Technology, for instance, upgraded its InCommand displays in 2020 and added SteadySteer and SteerCommand Z2 to its SteerCommand product line. End-users can use these products to control and steer all farm equipment from one interface.

CropX acquired CropMetrics in 2020 to expand its presence in the U.S. market. CropMetrics’s extensive dealer network, service model, and user-friendly platform were all used to help CropX expand into the U.S. market.

To strengthen their market presence and customer base, key market players are actively seeking partnerships and collaborations. AGCO Corporation formed a strategic partnership in 2021 with EZ-Drops (an innovative manufacturer of agricultural equipment) to offer its dealers in North America access to a new nutrient supply network. AGCO RoGator dealers can access the nutrient application system with custom configurations. This system will reduce nitrogen spraying, which can lead to lower farm profitability. The following are key players in the global smart farming market:

Маrkеt Кеу Рlауеrѕ:

- Ag Leader Technology

- AGCO Corporation

- Ag Junction, Inc.

- Ag Eagle Aerial Systems Inc.

- Autonomous Solutions, Inc.

- Argus Control Systems Ltd

- BouMatic Robotic B.V.

- CropMetrics

- CLAAS KGaA

- CropZilla

- Other Key Players

For the Smart Agriculture Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Smart agriculture market in 2021?A: The Smart agriculture market size is estimated to be US$ 14,740 million in 2021.

Q: What is the projected CAGR at which the Smart agriculture market is expected to grow at?A: The Smart agriculture market is expected to grow at a CAGR of 11% (2023-2032).

Q: List the segments encompassed in this report on the Smart agriculture market?A: Market.US has segmented the Smart agriculture market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Agriculture Type, the market has been segmented into Precision farming, Livestock monitoring, Smart greenhouse, and Other Agriculture Types. By Application, the market has been further divided into Precision farming application, Livestock monitoring application, and Smart greenhouse application.

Q: List the key industry players of the Smart agriculture market?A: Ag Leader Technology, AGCO Corporation, Ag Junction, Inc., Ag Eagle Aerial Systems Inc., Autonomous Solutions, Inc., Argus Control Systems Ltd, BouMatic Robotic B.V., Crop Metrics, and Other Key Players are the key vendors in the Smart Agriculture Market.

Q: Which region is more appealing for vendors employed in the Smart agriculture market?A: North America accounted for the highest revenue share of 44.9%. Therefore, the smart agriculture market in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Smart agriculture?A: The US, Canada, Mexico, UK, Japan, India, China & Germany are key areas of operation for the Smart Agriculture Market.

Q: Which segment accounts for the greatest market share in the Smart agriculture industry?A: With respect to the Smart agriculture industry, vendors can expect to leverage greater prospective business opportunities through the Livestock monitoring segment, as this area of interest accounts for the largest market share.

![Smart Agriculture Market Smart Agriculture Market]()

- Ag Leader Technology

- AGCO Corporation

- Ag Junction, Inc.

- Ag Eagle Aerial Systems Inc.

- Autonomous Solutions, Inc.

- Argus Control Systems Ltd

- BouMatic Robotic B.V.

- CropMetrics

- CLAAS KGaA

- CropZilla

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |