Global Snus Market By Product Type (Loose Snus and Portion Snus), By Application (Supermarkets/Hypermarkets, Tobacco Stores, and Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Sep 2021

- Report ID: 20974

- Number of Pages: 242

- Format:

- keyboard_arrow_up

Snus Market Overview:

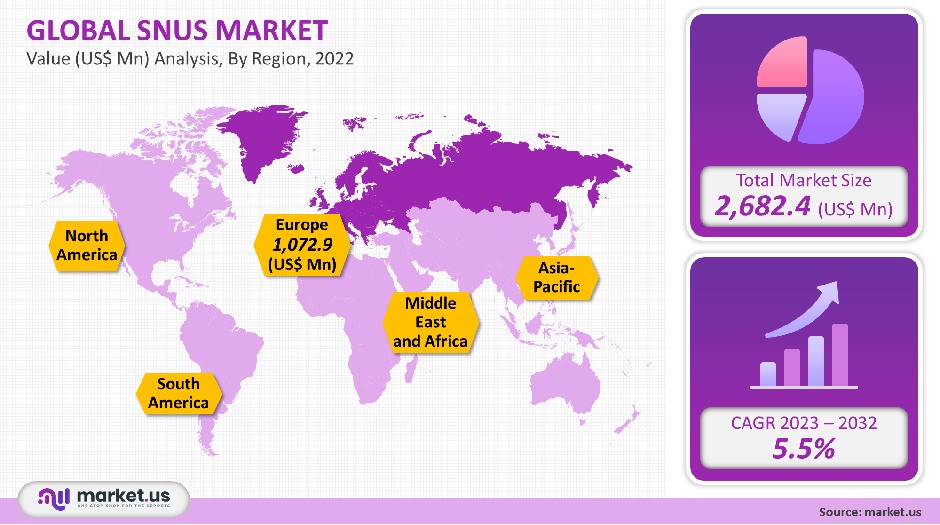

The global snus market was valued at USD 2,682.4 million in 2021 and is estimated to grow at 5.5% CAGR.

Due to its ease of use, snus has been growing in popularity. The convenience with which snus may be used everywhere, in contrast to cigarettes which are not allowed to smoke in public. Moreover, due to the detrimental effects of burning, there are no-smoking zones.

Global Snus Market

Product Type Analysis

Portion dominated the market, accounting for more than 80% of global revenue in 2021. The portion is made by packing tobacco into pouches. There are many options for them, including white, dry, and all-white. The original portion is dark and packed on a moist, porous surface. It delivers instant flavor and nicotine release.

The white parts aren’t moistened in manufacturing, so they offer less drip and longer-lasting nicotine release. In the coming years, the product is expected to grow at a rapid pace. One can get the portion snus in different sizes: slim, super slim, or mini. They all weigh less than one gram.

Key Segment Analysis

Product Type

- Loose Snus

- Portion Snus

Application

- Supermarkets/Hypermarkets

- Tobacco Stores

- Online Stores

Market Dynamics

The low prevalence of pancreatic, oral, and lung cancers is one of the reasons why the product is so popular among cigarette addicts. During the manufacturing procedure, the tobacco is not fermented. Unlike other types of smokeless tobacco, it is steam pasteurized rather than fermented. This inhibits the growth of cancer-causing bacteria. Other sorts of smokeless tobacco products often contain these compounds.

Because the byproduct is swallowed, rather than being spit into the lungs, it is easier to use. These positive attributes make snus products an ideal replacement for tobacco products like cigarettes, cigars, or smoke pipes.

A growing number of people are interested in flavored products. These include berries, fruits, and licorice. There are many subcategories that include the most popular flavors like mint, fruits, and berries. You can find mint snus in many flavors including spearmint and wintergreen as well as menthol.

Another product that has seen huge popularity is tobacco-free snus.To maintain the product’s popularity in the global marketplace, manufacturers have developed tobacco-free products. This has resulted in a steady decline in the use of tobacco. People who are trying to reduce or quit smoking can benefit from the product. These products contain a combination of herbs, flavors, and other ingredients that combine to create a similar experience as regular snus. They also come in a variety of flavors and brands. Grinds and KickUp are just a few of the companies that offer these products.

Regional Analysis

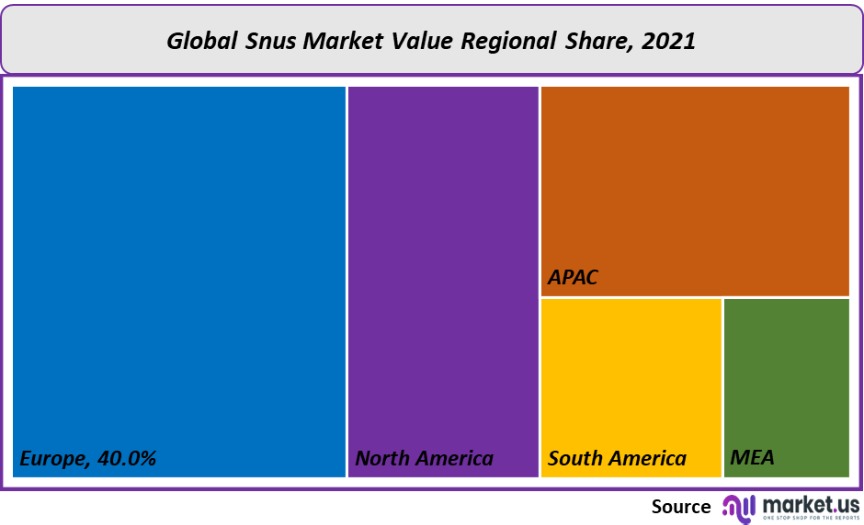

In 2021, Europe was the largest market, accounting for more than 40% of worldwide revenue. The sector is projected to stay afloat because of the great appeal of such products among males in Scandinavian countries like Sweden and Norway. Because of the increasing number of product releases in the aforementioned countries, the area will continue to dominate in the future.

Between 2023 and 2032, MEA will increase at the fastest rate of 9.3%. It has the smallest tobacco sales restrictions. In Africa, it’s known as male. In no African country, snus is prohibited. More national and international organizations are attempting to minimize the number of smokers in Africa. Because they have been demonstrated to be successful in reducing smoking addiction, these products are quickly gaining traction in the region. They’re also incredibly affordable, and customers are increasingly interested in them.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

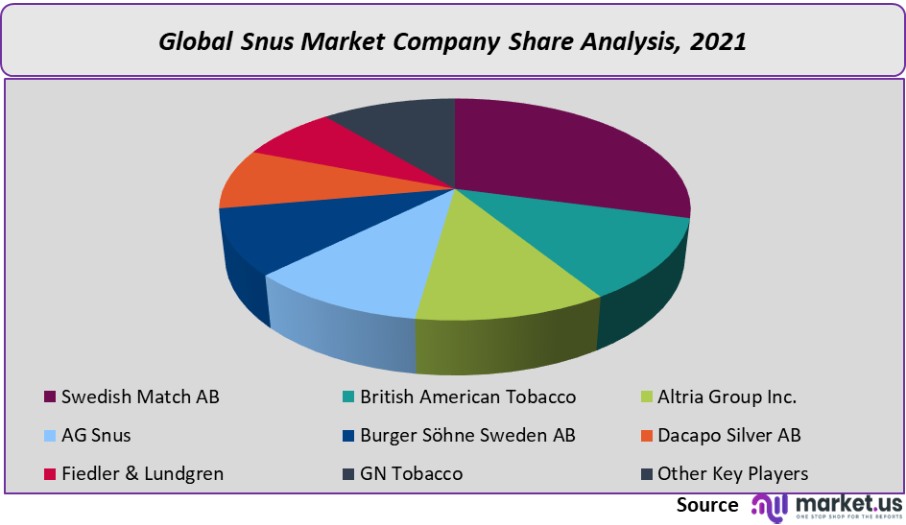

Market share Analysis

In most countries, advertising for tobacco products has been prohibited. The FDA granted permission to tobacco manufacturer companies to market products that are not very harmful compared to smoking cigarettes in October 2019. Moreover, FDA found that smoking snus can be used to quit smoking cigarettes and approved this advertisement.

In the next few years, new product launches will be a key strategy for market players. Swedish Match has launched new snus models in 2019 such as XR Goteborgsrape sparkling slim white. General Onyx was also used to reposition snus products. Its distinctive feature is the onyx-black pouches. These new product launches are expected to increase Swedish Match’s market share in the coming years.

Key Market Players:

The following are the top players in the global snus market:

- British American Tobacco PLC

- Dacapo Silver

- Swedish Match

- AG Snus

- Altria Group Inc.

- GN Tobacco

- Burger Söhne Sweden AB

- Fiedler & Lundgren AB

- Other Key Players

For the Snus Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Snus market size in 2021?A: The Snus market size is US$ 2,682.4 million for 2021.

Q: What is the CAGR for the Snus market?A: The Snus market is expected to grow at a CAGR of 5.5% during 2023-2032.

Q: What are the segments covered in the Snus report?A: Market.US has segmented the Global Snus Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product type, market has been segmented into loose snus, and portion snus. By application, market has been divided Supermarket, tobacco store and online.

Q: Who are the key players in the Snus market?A: Swedish Match AB, British American Tobacco, Altria Group Inc., AG Snus, Burger Söhne Sweden AB, Dacapo Silver AB, Fiedler & Lundgren, and GN Tobacco among others.

Q: Which region is more attractive for vendors in the Snus market?A: Europe is accounted for the largest revenue share among the other regions in 2021. Therefore, the Snus market in Europe is expected to garner significant business opportunities during the forecast period.

Q: What are the key markets for Snus market?A: Key markets for snus market are the UK, France, and the US.

Q: Which segment has the largest share in the Snus market?A: In the Snus market, Portion dominated the market as it accounted for 80% of global revenue in 2021.

![Snus Market Snus Market]()

- British American Tobacco PLC

- Dacapo Silver

- Swedish Match

- AG Snus

- Altria Group Inc.

- GN Tobacco

- Burger Söhne Sweden AB

- Fiedler & Lundgren AB

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |