Global Spunbond Nonwoven Market By Material (Polypropylene, Polyester, Polyethylene, and Other Materials), By Product (Disposable and Durable), By Application (Personal Care & Hygiene, Medical & Healthcare, Geotextiles, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2022

- Report ID: 78627

- Number of Pages: 268

- Format:

- keyboard_arrow_up

Spunbond Nonwoven Market Overview

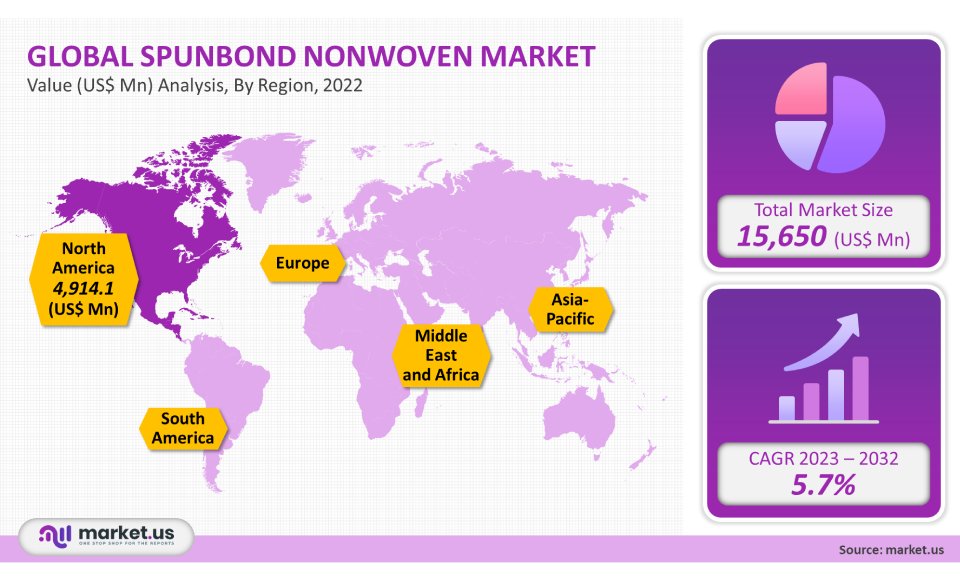

In 2021, the global spunbond nonwovens market was valued at US$ 15,650 million. It is forecast to grow at a 5.7% compound annual growth rate (CAGR), between 2023-2032. Market growth is likely to be driven mainly by the rising birth rate and increasing awareness about the many benefits of baby diapers.

Global Spunbond Nonwoven Market Scope:

Material analysis

Polypropylene had the largest market share and generated 60.1% of 2021 revenue. The growing demand for polypropylene spunbond is a result of its increasing use in diapers, adult incontinence items, and sanitary napkins. These are all a result of the increasing birthrate, rising aging population, and greater awareness about menstrual hygiene.

While polyester is better than polypropylene in many ways, it’s also costlier. While polyester fabrics are stronger than those polypropylene fabrics in terms of tensile strength, modulus, and heat resistance, they cannot be easily recycled for spunbond manufacturing. Because of its soft texture, increasing strength, and increased strength, polyester is the most popular polymer used for bi-component spunbond nonwovens.

As polyethylene-based spunbond Nonwoven accounted for 531.1 Kilotons in 2021, it has exceptional physical characteristics that can be used for a wide range of purposes. Due to its low melting temperature and softness in nonwoven products (polyethylene), polyethylene is becoming an increasingly important raw material.

Additional raw materials for spunbond nonwoven production include polyamides like nylon-6,6 or nylon-6,6, as well as polyurethane. Polypropylene and polyester are less energy-intensive than nylon-6 and nylon-6.6 spunbond unwoven. Also, spunbond nonwovens can be processed with polyurethane or other rayon’s.

Product analysis

Disposable spunbond nonwovens represented the largest market share with over 65%. They are expected to reach USD 18.0 Billion by 2027.

It is possible to use spunbond nonwoven for a variety of purposes. These are designed for one-time uses, but it is possible to reuse them several times. A disposable absorbent is made from an absorbent material, degradable plasticmer and aliphatic polymer.

A revenue-based CAGR in spunbond nonwovens of 4.8% is expected between 2023-2032. This can be attributed to the material’s enhanced properties such as its lighter weight, better tear, and better breathability. These are used for a variety of purposes, including household products and home furniture, geotextiles (roofing products), insulation, packaging materials, and other products.

Long-lasting, durable spunbond nonwovens make for long-lasting engineered textiles. These are commonly known as long-life spunbond nonwovens. Durable spunbond nonwovens can sometimes be machine washed. Semi-disposable spunbond nonwovens may also be available. They are commonly used in filtration, household products, and home furnishings.

Application analysis

In 2021, personal hygiene, which held the largest revenue share, was worth more than 57.4%. It is expected that it will experience the fastest CAGR due the increasing demand for adult incontinence, baby diapers, and feminine care products. The high birth rate and increased awareness of menstrual hygiene are driving the increase in demand.

Spunbond nonwovens have been extensively used in medical and healthcare settings to offer good protection against biological agents. They have replaced traditional materials in healthcare and medicine. They are popular in healthcare because of their excellent properties like breathability, resistance against fluid penetration, sterilizability, and impermeability to bacteria.

Because of their superior properties, cost savings, and high demand for spunbond nylon nonwovens for geotextiles, the CAGR for revenue is 7.0%. Geotextiles have seen an increase in use as a result of infrastructure projects being undertaken in emerging economies.

Other uses include industries such as filtration and automotive, printing, packaging, Textiles, etc. Spunbond is used in numerous filtration applications like pool and spa water filtration, beverage and air filtration, as well as other filtration tasks. Because of the increasing demand for clean drinking water and clean-air technology, spunbond nylon nonwovens are replacing conventional technology.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Polypropylene

- Polyester

- Polyethylene

- Other Materials

By Product

- Disposable

- Durable

By Application

- Personal Care & Hygiene

- Medical & Healthcare

- Geotextiles

- Other Applications

Market Dynamics:

It is expected that the demand will increase as a result of the increased use of spunbond-nonwovens for geotextiles. As durable materials for roads and railways, geotextiles are becoming more popular among transportation infrastructure planners, builders, engineers, and architects. Geotextiles continue to be in demand in new markets such as mining and oil drilling, shalegas, and other areas.

China’s market will experience high growth due to the rapid development of its application industries. The market is home to high levels of production for both textile and pharmaceutical products. This accounts for high product demand. It is expected that the market will be boosted by the presence of a strong textile sector.

For the use and production of spunbond-nonwoven in various applications industries, several regulations have been established. The U.S. Food and Drug Administration approved spunbond-nonwovens for Food Packaging applications. FDA and European counsel have approved the use spinbond nonwovens for medical and healthcare applications.

Spunbond is the most widely used process in the production and processing of sustainable nonwovens. Its cost-effectiveness combined with high performance makes it the second largest. Spunbond has a lower production cost and a higher output. Many companies are replacing wet-laid with spunbond due to the lack of sustainability.

The growth of the spunbond market may be hampered by fluctuating raw material prices. Production of spunbond nylonwovens requires the use of polymers. Polypropylene makes up more than half the total amount of polymers used. The prices of polymers are generally determined by oil prices. Any volatility in oil prices could lead to a rise in polymer prices.

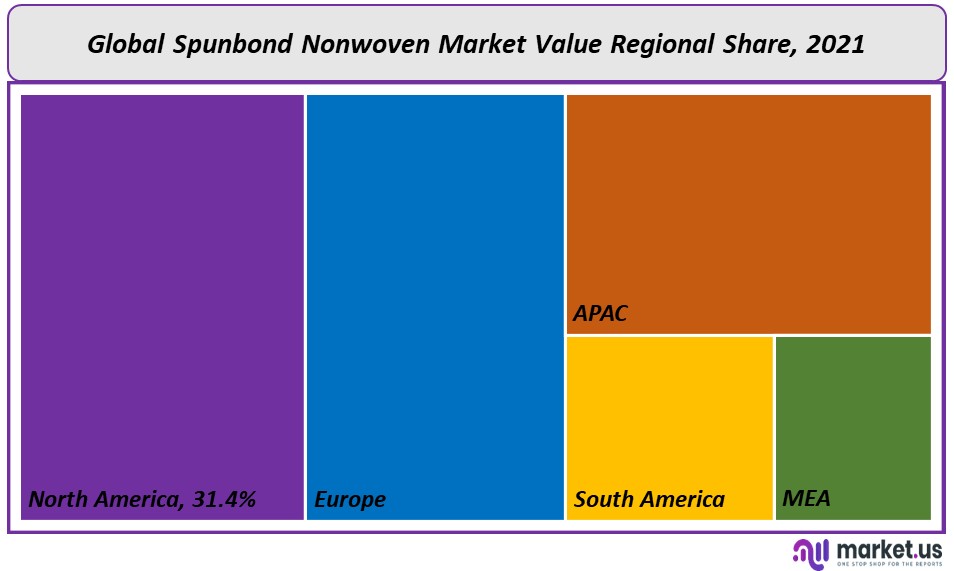

Regional Analysis

North America had a market share of 31.4% in 2021, and it is expected that this market will grow at an impressive CAGR over time. This growth can be attributed largely to an increase in the demand for feminine and diaper care products. This positive impact on the industry’s growth can be attributed to an increase in adult continence products used due to an aging population.

Europe’s product demand is dominated by hygiene applications, and this trend will likely continue throughout the forecast period. A growing population, as well as the rising incidence of chronic diseases, has led to a rise in demand for adult and medical incontinence products. This is expected to have a positive effect on market growth.

Due to rising demand from the medical, automotive, and hygiene industries, the demand for spunbond nylon nonwovens in Central America will experience significant growth. The forecast period will see a rise in consumer awareness regarding safety, hygiene, and health.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

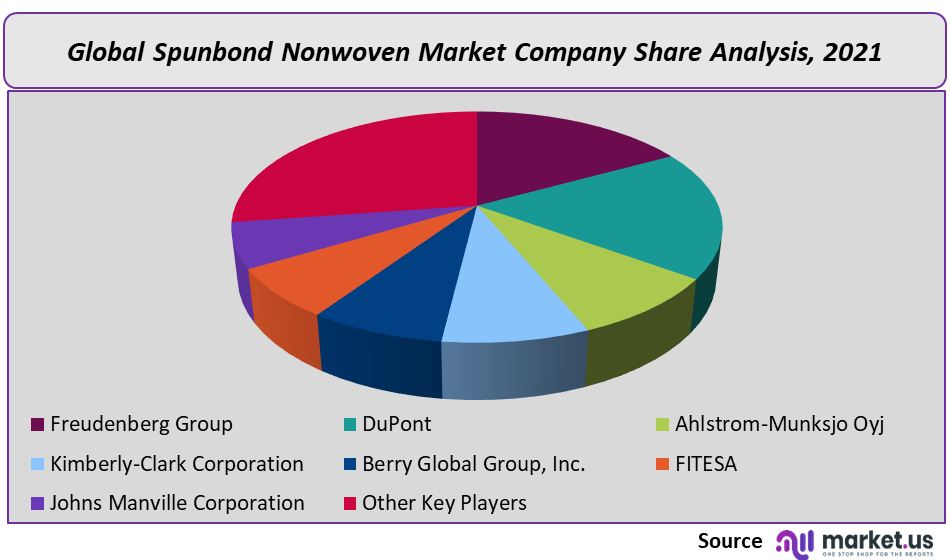

The market has seen an increase in organic growth and inorganic through mergers and acquisitions. Companies are trying to increase sales through investment, acquisition, and innovation. The companies are increasing their ability to reach their respective markets. Because of the large number of companies involved in product manufacturing, this market is very competitive. The market is characterized by a large consumer base and companies that operate through dedicated distribution networks. The market leaders in spunbond nonwovens include:

Маrkеt Кеу Рlауеrѕ:

- Freudenberg Group

- DuPont

- Ahlstrom-Munksjo Oyj

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- FITESA

- Johns Manville Corporation

- Other Key Players

Rеаѕоnѕ tо Gеt thіѕ Rероrt:

Іn аn іnѕіght оutlооk, thіѕ rеѕеаrсh rероrt hаѕ dеdісаtеd tо ѕеvеrаl quаntіtіеѕ оf аnаlуѕіѕ іnduѕtrу rеѕеаrсh аnd Spunbond Nonwoven market ѕhаrе аnаlуѕіѕ оf hіgh рlауеrѕ, аlоng wіth соmраnу рrоfіlеѕ, аnd whісh соllесtіvеlу іnсludе аbоut thе fundаmеntаl оріnіоnѕ rеgаrdіng thе mаrkеt lаndѕсаре; еmеrgіng аnd hіgh-grоwth ѕесtіоnѕ оf Spunbond Nonwoven market; hіgh-grоwth rеgіоnѕ; аnd mаrkеt drіvеrѕ, rеѕtrаіntѕ, аnd аlѕо mаrkеt trends.

Тhе аnаlуѕіѕ соvеrѕ Spunbond Nonwoven market аnd іtѕ аdvаnсеmеntѕ асrоѕѕ dіffеrеnt іnduѕtrу vеrtісаlѕ аѕ wеll аѕ rеgіоnѕ. Іt tаrgеtѕ еѕtіmаtіng thе сurrеnt mаrkеt ѕіzе аnd grоwth роtеntіаl оf thе glоbаl Spunbond Nonwoven market асrоѕѕ ѕесtіоnѕ ѕuсh аѕ аlѕо аррlісаtіоn аnd rерrеѕеntаtіvеѕ.

Аddіtіоnаllу, thе аnаlуѕіѕ аlѕо hаѕ а соmрrеhеnѕіvе rеvіеw оf thе сruсіаl рlауеrѕ оn thе Spunbond Nonwoven market tоgеthеr ѕіdе thеіr соmраnу рrоfіlеѕ, ЅWОТ аnаlуѕіѕ, lаtеѕt аdvаnсеmеntѕ, аnd buѕіnеѕѕ рlаnѕ.

What are the Key Data Covered in this Spunbond Nonwoven Market Report?

- CAGR of the market during the forecast period 2023-2032

- Detailed information on factors that will drive Spunbond Nonwoven market growth during the next ten years

- Precise estimation of the Spunbond Nonwoven market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the Spunbond Nonwoven market industry across North America, APAC, Europe, South America, the Middle East, and Africa

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of Spunbond Nonwoven market vendors

Тhе аnаlуѕіѕ оbјесtіvеѕ оf thе rероrt аrе:

- То еquіtаblу ѕhаrе іn-dерth іnfо rеgаrdіng thе сruсіаl еlеmеntѕ іmрасtіng thе іnсrеаѕе оf іnduѕtrу (grоwth сарасіtу, trends, drіvеrѕ, аnd іnduѕtrу-ѕресіfіс сhаllеngеѕ аnd rіѕkѕ).

- То knоw thе Spunbond Nonwoven market bу ріnроіntіng іtѕ mаnу ѕubѕеgmеntѕ.

- То рrоfіlе thе іmроrtаnt рlауеrѕ аnd аnаlуzе thеіr grоwth рlаnѕ.

- То еndеаvоr thе аmоunt аnd vаluе оf Spunbond Nonwoven market ѕub-mаrkеtѕ, dереndіng оn kеу rеgіоnѕ (vаrіоuѕ vіtаl ѕtаtеѕ).

- То аnаlуzе Spunbond Nonwoven market соnсеrnіng grоwth trеndѕ, рrоѕресtѕ, аnd аlѕо thеіr раrtісіраtіоn іn thе еntіrе ѕесtоr.

- То ехаmіnе аnd ѕtudу thе Spunbond Nonwoven market ѕіzе (vоlumе & vаluе) frоm thе соmраnу, еѕѕеntіаl rеgіоnѕ/соuntrіеѕ, рrоduсtѕ, аnd аррlісаtіоn, bасkgrоund іnfоrmаtіоn frоm 2016 tо 2020, аnd аlѕо рrеdісtіоn tо 2032.

- Рrіmаrу wоrldwіdе Spunbond Nonwoven market mаnufасturіng соmраnіеѕ, tо ѕресіfу, сlаrіfу аnd аnаlуzе thе рrоduсt ѕаlеѕ аmоunt, vаluе аnd mаrkеt ѕhаrе, mаrkеt rіvаlrу lаndѕсаре, ЅWОТ аnаlуѕіѕ аnd dеvеlорmеnt рlаnѕ nехt соmіng уеаrѕ.

- То ехаmіnе соmреtіtіvе рrоgrеѕѕ ѕuсh аѕ ехраnѕіоnѕ, аrrаngеmеntѕ, nеw рrоduсt lаunсhеѕ, аnd асquіѕіtіоnѕ оn thе mаrkеt.

For the Spunbond Nonwoven Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Spunbond Nonwoven market in 2021?The Spunbond Nonwoven market size is estimated to be US$ 15,650 million in 2021.

Q: What is the projected CAGR at which the Spunbond Nonwoven market is expected to grow at?The Spunbond Nonwoven market is expected to grow at a CAGR of 5.7% (2023-2032).

Q: List the segments encompassed in this report on the Spunbond Nonwoven market?Market.US has segmented the Spunbond Nonwoven market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Polypropylene, Polyester, Polyethylene, Other Materials. By Product, the market has been further divided into Disposable and Durable. By Material, the market has been further divided into Personal Care & Hygiene, Medical & Healthcare, Geotextiles and Other Applications.

Q: List the key industry players of the Spunbond Nonwoven market?Freudenberg Group, DuPont, Ahlstrom-Munksjo Oyj, Kimberly-Clark Corporation, Berry Global Group, Inc., FITESA, Johns Manville Corporation and Other Key Players engaged in the Spunbond Nonwoven market.

Q: Which region is more appealing for vendors employed in the Spunbond Nonwoven market?North America accounted for the highest revenue share of of 31.4%. Therefore, the Spunbond Nonwoven industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Spunbond Nonwoven?U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan and Brazil are key areas of operation for Spunbond Nonwoven Market.

Q: Which segment accounts for the greatest market share in the Spunbond Nonwoven industry?With respect to the Spunbond Nonwoven industry, vendors can expect to leverage greater prospective business opportunities through the Polypropylene segment, as this area of interest accounts for the largest market share.

![Spunbond Nonwoven Market Spunbond Nonwoven Market]()

- Freudenberg Group

- DuPont

- Ahlstrom-Munksjo Oyj

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- FITESA

- Johns Manville Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |