Global Steam Turbine Market By Capacity, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 21035

- Number of Pages: 292

- Format:

- keyboard_arrow_up

Steam Turbine Market Overview:

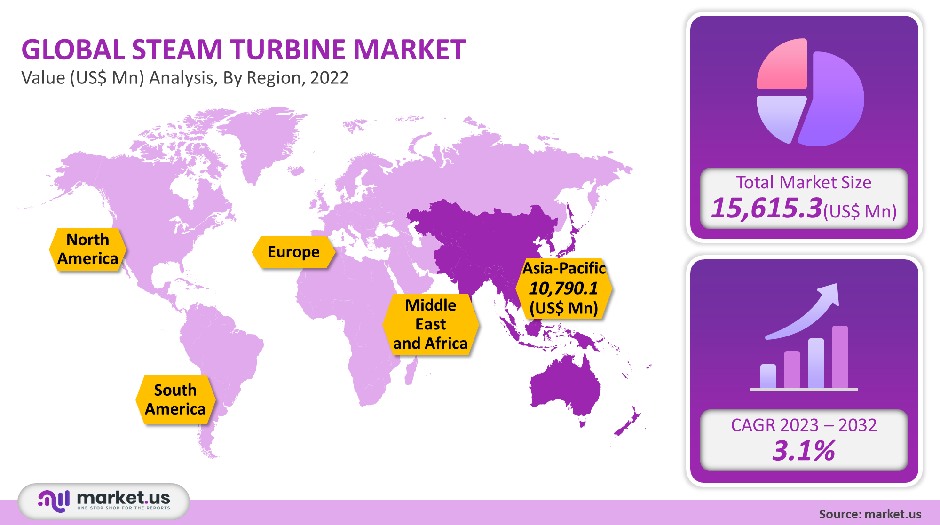

The Steam Turbine Market size is expected to be around USD 21.190.29 million by 2031 from USD 15,615.3 million in 2021, growing at a CAGR of 3.1% during the forecast period 2021 to 2031.

To compensate for the energy shortage, it is probable that more power plants will be built. This is expected to increase steam turbine demand in the future.

Global Steam Turbine Market Scope:

Capacity Analysis

More than 300 MW was the biggest revenue generator, accounting for more than 61.5% of total revenue in 2021. Due to the growing demand for industrial CHP units, steam turbines with a 150 MW capacity will likely see significant growth over the forecast period. Drivers With the rising electricity demand, the demand for steam turbines is also likely to rise.

Steam turbines are electric devices that extract thermal power plants from pressurized steam and convert them into kinetic energy.

CHP units are becoming more popular in different industries due to their higher efficiency than single units. CHP is also a source of direct power, electricity, and heat and has seen a rise in demand in recent years. The market can be divided into three segments based on its capacity: 150 to 300 MW and more than 300 MW.

The segment 151-300 MW is expected to see the most significant growth due to the high demand for small steam engines in small and medium-sized combined cycle power plants (CCPP), combined heat power (CHP), and biomass. Due to high demand from steel and chemical industries, steam turbine manufacturers focus more on small steam turbines. Due to the shift to renewable and cleaner energy technologies from coal-based power technologies across the globe, the demand for large-capacity Steam Turbines will likely decline. However, the market value for large-capacity steam engines is expected to rise due to increased demand from developing countries like India and China for continuous power supply.

End-Use Analysis

The market leader in revenue was the power and utility segment, accounting for over 86.2% of the total. The market’s dominant position will continue during the forecast unit value. The steam turbine has been used to generate electricity for a long time.

The market is segmented on end-use into power, utility, and industrial. Although steam turbine units can be used with any type of combustion fuel, coal was the preferred fuel in the past. The use of coal-fired power stations has been restricted due to environmental concerns. Instead, we have turned to clean energy sources like natural gas. The use of renewable energy is also a necessity.

The increase in industrial activity around the globe is responsible for the growth of the industrial sector. In industrial applications, steam turbines are used as CHP units. These units are more efficient than single units and can produce multiple outputs. Additionally, the rising demand for steam turbines in industrial power plants has been fueled by frequent power outages and load limits.

Кеу Маrkеt Ѕеgmеntѕ

By Capacity

- 1-120 MW

- 151 to 300 MW

- Up to 150 MW

- 351-750 MW

By End-Use

- Industrial

- Power & Utility

Market Dynamics:

In 2021, the United States was the largest North American market. The U.S. has a growing demand for steam turbines due to the increased number of combined-cycle natural gas plants. These plants are a renewable energy source and are one reason the market is expanding. This will lead to an increase in steam turbine installations in America in the next few years.

CHP installations have risen in the United States due to the increased focus of the U.S. Government on establishing clean, energy-efficient power generation plants. The market is expected to grow due to the rising demand for power in North America over the forecast period.

The U.K. is focusing its policymakers on reducing carbon emissions and generating energy efficiently. These efforts have led to the creation and strict implementation of numerous emission and environmental norms. CHP units use steam turbines in industrial applications.

Due to logistical issues and delayed production of steam turbine parts, the COVID-19 pandemic has impeded the global market for steam turbine growth. This causes delays in steam turbine installation projects. Due to the diversion by steam turbine buyers of funds to support the COVID-19 crisis, there has been a reduction in turbine installation orders. Manufacturers of steam turbines have made it a point to supply turbines to customers involved in ongoing projects. Vendors choose digital tools, follow social distancing rules, and use PPE for new power plant installations.

The outbreak of COVID-19 had a negative impact on the growth of the steam turbine market.

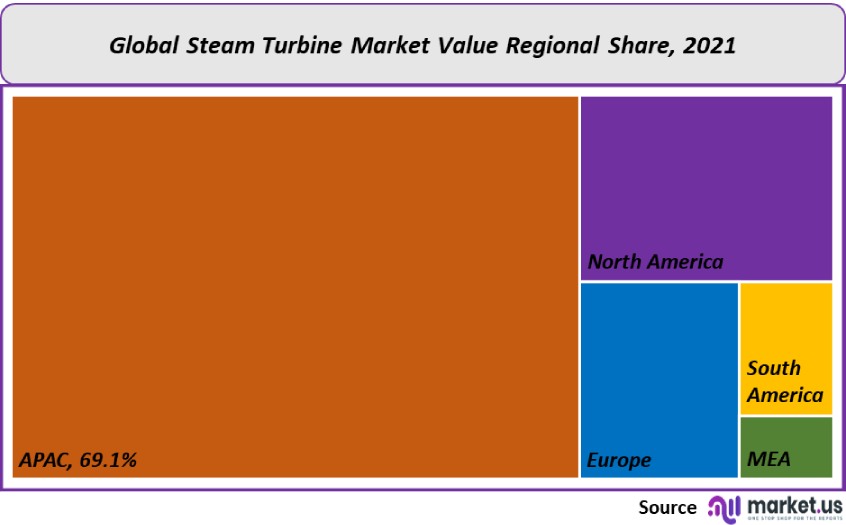

Regional Analysis

In 2021, the Asia-Pacific CAGR accounted for 69.1% of all revenue. This region is expected to experience the fastest growth rate over the forecast period. As many fossil and biomass power stations are constructed in countries like Indonesia, South Korea, Thailand, Bangladesh, and Japan, the Asia Pacific region will continue to be the dominant market in volume and value.

This will help support the market growth during the forecast period. Due to rapid industrialization and a growing population, the demand for electricity in the region is increasing. This is driving the development of clean coal technology, thereby increasing the demand for steam turbines.

CHP applications in America are an everyday use of steam turbines. Steam turbine-based generators generate electricity using heat, unlike reciprocating engine CHP systems and gas turbines. Because separate heat sources power steam turbines, they do not convert fuel to electricity. High-pressure steam powers generators and turbines and transfers the energy from boilers to turbines.

Due to rapid industrialization, Russia’s demand for power is increasing rapidly, pushing down the current production limits. In addition, the country’s high-energy industrial users consider the key benefits of both onsite and self-generation due to rising electricity prices and concerns about the uninterrupted and secure power supply.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of the Middle East and Africa

Market Share & Key Players Analysis:

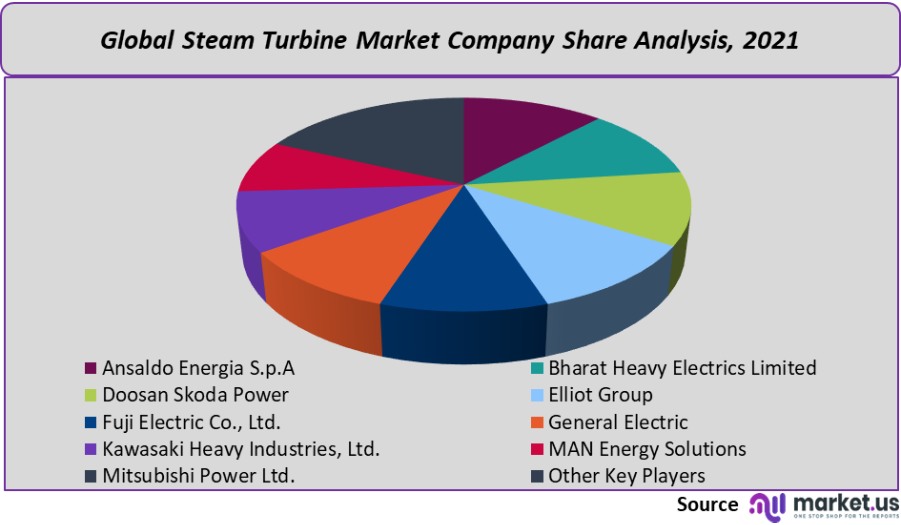

Globalization is key to market competition, with international trade being an important part of sustainable growth. Many of these players have formed joint ventures with multiple customers and suppliers worldwide that increase their market share, lower costs, and allow them to access new markets.

The market’s most prominent players are focusing their efforts on critical assets such as product customization, the development of new product ranges, and inorganic growth ventures. Market players also offer services for maintenance and up-gradation to help them gain competitive advantages over their competitors. The following are some of the most prominent players in the global steam turbine market:

Маrkеt Кеу Рlауеrѕ:

- Ansaldo Energia S.p.A

- Bharat Heavy Electricals Limited

- Doosan Skoda Power

- Elliot Group

- Siemens AG

- Fuji Electric Co., Ltd.

- Harbin Electric Corporation

- General Electric

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions

- Mitsubishi Hitachi power systems.

- Siemens Energy

- Toshiba Corporation

- Arani Power Systems

- Other Key Players

For the Steam Turbine Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the steam turbine market in 2021?The Steam turbine market size was US$ 15,615.3 million in 2021.

What is the projected CAGR at which the Steam turbine market is expected to grow?The Steam turbine market is expected to grow at a CAGR of 3.1% (2023-2032).

List the segments encompassed in this report on the Steam turbine market?Market.US has segmented the Steam turbine market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Capacity, the market has been segmented into 151 to 300 MW, Up to 150 MW, and More than 300 MW. By End-Use, the market has been further divided into Industrial and Power & Utility.

List the key industry additional market player in the Steam turbine market?Ansaldo Energia S.p.A, Bharat Heavy Electrics Limited, Doosan Skoda Power, Elliot Group, fuji electric co. ltd., General Electric, Mitsubishi Hitachi power systems, Kawasaki Heavy Industries, Ltd., Bharat Heavy Electricals Limited (India), MAN Energy Solutions, Siemens AG, Mitsubishi Power Ltd., Siemens Energy, and Other Key Players engaged in the Steam Turbine Market.

Which region is more appealing for vendors employed in the Steam turbine market?APAC is expected to account for the highest revenue share of 69.1%. Therefore, the Steam turbine industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Steam turbine?China, India, The US, Canada, the UK, Japan, & Germany are key areas of operation for the Steam Turbine Market.

Which segment accounts for the greatest market share in the steam turbine industry?With respect to the Steam turbine industry Trend, vendors can expect to leverage greater prospective business opportunities through the More than 300 MW segment, as this area of interest accounts for the largest market share.

![Steam Turbine Market Steam Turbine Market]()

- Ansaldo Energia S.p.A

- Bharat Heavy Electricals Limited

- Doosan Skoda Power

- Elliot Group

- Fuji Electric Co., Ltd.

- General Electric

- Siemens AG

- Harbin Electric Corporation

- Kawasaki Heavy Industries, Ltd. Company Profile

- MAN Energy Solutions

- Mitsubishi Hitachi power systems.

- Toshiba Corporation Company Profile

- Siemens Energy

- Arani Power Systems

- Bharat Heavy Electricals Ltd's

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |