Global Surgical Sealants & Adhesives Market By Type (Natural or Biological Adhesives and Sealants, Synthetic and Semi-Synthetic Adhesives and Sealants), By Application (Central Nervous System, Cardiovascular, Orthopaedic, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 29466

- Number of Pages: 244

- Format:

- keyboard_arrow_up

Surgical Sealants and Adhesives Market Overview:

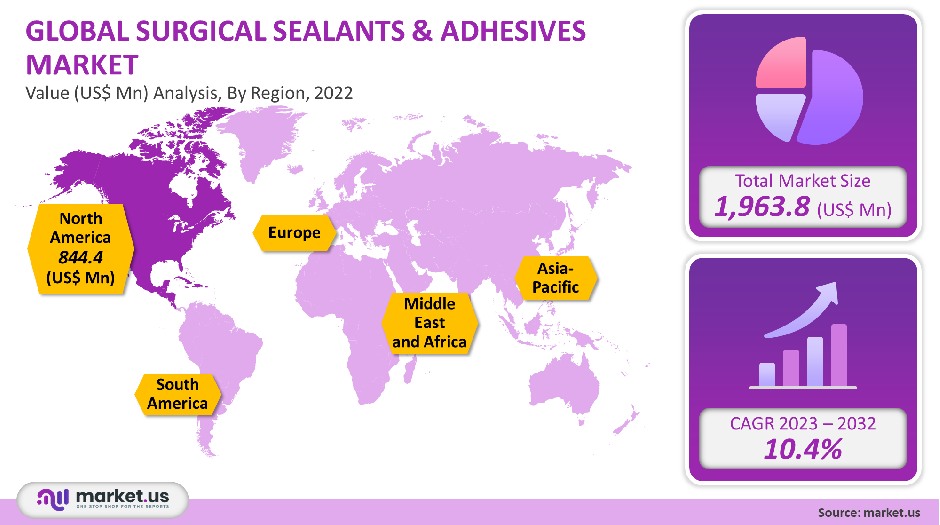

The global market for Surgical Sealants & Adhesives was worth USD 1,963.8 million in 2021. This market is expected to grow at a CAGR, of 10.4% between 2023-2032.

The use of adhesives and sealants has evolved to be a useful complement to modern surgical procedures. Because of their safety, efficacy, and usefulness in repairing damaged tissues and supporting wounds during surgery, they are popular.

Global Surgical Sealants & Adhesives Market Analysis

Product Type Analysis

In 2021, natural adhesives and sealants held the largest revenue share with more than 62%. Because of their widespread use in medical practice, fibrin sealants a type of natural/biological adhesives and sealants had the highest revenue share in 2021. They have many uses in the thoracic, orthopedic, neuro, and reconstructive fields.

Fibrin is among the few products that have been approved by FDA for use under all three groups: hemostats, sealants, and adhesives. Because of their high drying speed, Cyanoacrylates a type of synthetic sealants and adhesives will be the most popular in the forecast period. Its high mechanical strength and ease in adhesion have led to its increasing adoption in surgical practices around the world.

Cyanoacrylates have been known to trigger intense inflammatory responses when they are in contact with non-cutaneous surfaces. This makes them less suitable for internal surgery. Cyanoacrylates can only be used for external injuries and surgeries. This will likely slow down its market growth.

Application Analysis

General surgery accounted for a significant revenue share in 2021. CNS (central nervous system) had the second largest revenue share in 2021 due to the global prevalence of CNS conditions. CNS surgeries prefer sealants to traditional closure methods such as wires, sutures, or staples.

CNS surgeries can be difficult for traditional sealant methods. This has led to a surge in the demand for surgical adhesives and sealants for CNS. In 2021, the largest revenue share was held by the cardiovascular segment. Market growth is expected to be driven by an increasing number of cardiovascular procedures and cardiovascular surgeries like open-heart surgery and cardiac valve procedures.

Key Market Segments

By Type

- Natural or Biological Adhesives and Sealants

- Synthetic and Semi-Synthetic Adhesives and Sealants

By Application

- Central Nervous System

- Cardiovascular

- Orthopedic

- General Surgery

- Other Applications

Market Dynamics

COVID-19’s pandemic in the world resulted in nationwide lockdowns and put immense pressure on healthcare systems. According to the American College of Surgeons’ list, any dental, medical, or surgical procedure that is not essential and elective was postponed except in cases of a medical emergency.

The growing demand for surgical services and the increasing awareness of the need to minimize surgical wounds are two factors that have contributed to this market’s growth. The global number of procedures has significantly increased. According to WHO estimates, there is approximately 250 million major surgery performed annually worldwide. There is always a risk of tissue injury, excessive bleeding, or wound infection after major surgical procedures. Patients suffering from diabetes must be more cautious because they have a higher chance of complications both during and after surgery.

As surgeries increase in number, R&D is intensifying to improve surgical sealants. Because of their minimal blood loss, superior wound healing capabilities, and traditional surgical sealants like staples and sutures are likely to be replaced with surgical sealants and adhesives. The sealants require no removal and are much less painful than traditional sutures. Due to high prices, sealants are currently not seeing much market growth. Additionally, market growth is limited by strict regulatory approvals.

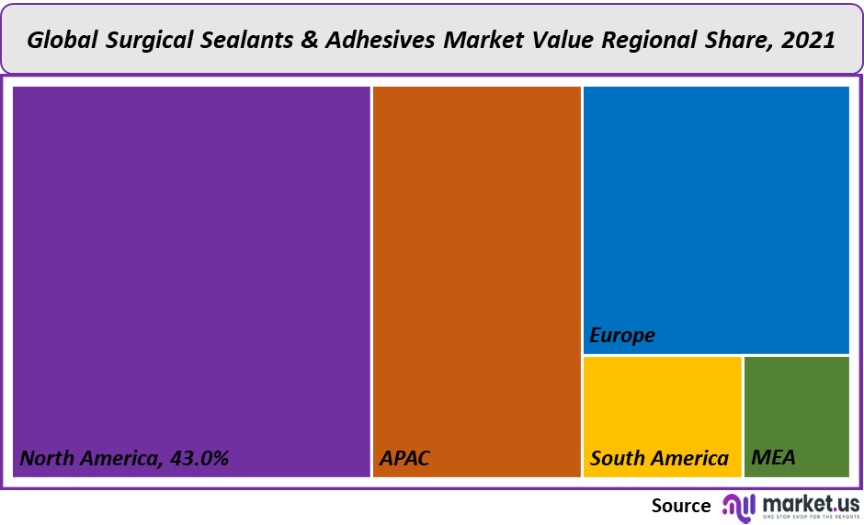

Regional Analysis

North America accounted for the majority of the revenue share of 43% in 2021. This is due to the high-quality medical care and modern technology. The U.S.’s increasing emphasis on surgical care is expected to contribute positively to the market’s growth.

CryoLife and Baxter International are just a few of the major market players in the area. The Asia Pacific is projected to experience significant growth during the forecast period due to the ongoing transformation in healthcare delivery systems to advanced value-based care practices that create a sustainable system of health. This will enable people to get better services at lower costs, as well as encourage the use of novel techniques in healthcare

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

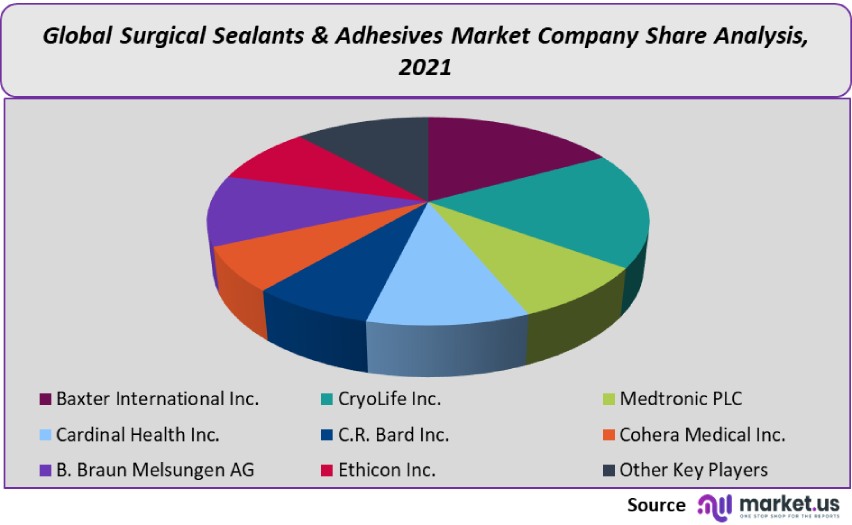

Market participants are a mixture of large public companies and many smaller specialized companies. Cohera Medical, Inc., however, has a product portfolio that only includes surgical sealants. There are new players expected to enter the market, increasing competition. In order to maintain their market dominance, leading players are constantly implementing new strategies.

Маrkеt Кеу Рlауеrѕ:

- Baxter International Inc.

- CryoLife Inc.

- Medtronic PLC

- Cardinal Health Inc.

- C.R. Bard Inc.

- Cohera Medical Inc.

- B. Braun Melsungen AG

- Ethicon Inc. [J&J]

- Other Key Players

For the Surgical Sealants and Adhesives Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Surgical Sealants & Adhesives market in 2021?A: The Surgical Sealants & Adhesives market size is US$ 1,963.8 million in 2021.

Q: What is the projected CAGR at which the Surgical Sealants & Adhesives market is expected to grow at?A: The Surgical Sealants & Adhesives market is expected to grow at a CAGR of 10.4% (2023-2032).

Q: List the segments encompassed in this report on the Surgical Sealants & Adhesives market?A: Market.US has segmented the Surgical Sealants & Adhesives market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Natural or Biological Adhesives and Sealants and Synthetic and Semi-Synthetic Adhesives and Sealants. By Application, the market has been further divided into Central Nervous System, Cardiovascular, Orthopedic, General Surgery, and Other Applications.

Q: List the key industry players of the Surgical Sealants & Adhesives market?A: Baxter International Inc., CryoLife Inc., Medtronic PLC, Cardinal Health Inc., C.R. Bard Inc., Cohera Medical Inc., B. Braun Melsungen AG, Ethicon Inc. [J&J], and Other Key Players are engaged in the Surgical Sealants & Adhesives market

Q: Which region is more appealing for vendors employed in the Surgical Sealants & Adhesives market?A: North America is expected to account for the highest revenue share of 43%. Therefore, the Surgical Sealants & Adhesives industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Surgical Sealants & Adhesives?A: The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Surgical Sealants & Adhesives Market.

Q: Which segment accounts for the greatest market share in the Surgical Sealants & Adhesives industry?A: With respect to the Surgical Sealants & Adhesives industry, vendors can expect to leverage greater prospective business opportunities through the Natural or Biological Adhesives and Sealants segment, as this area of interest accounts for the largest market share.

![Surgical Sealants and Adhesives Market Surgical Sealants and Adhesives Market]() Surgical Sealants and Adhesives MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Surgical Sealants and Adhesives MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Baxter International Inc.

- CryoLife Inc.

- Medtronic PLC

- Cardinal Health Inc.

- C.R. Bard Inc.

- Cohera Medical Inc.

- B. Braun Melsungen AG Company Profile

- Ethicon Inc. [J&J]

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |