Global Automotive Tire Market By Application, By Tire Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2021

- Report ID: 22409

- Number of Pages: 268

- Format:

- keyboard_arrow_up

Automotive Tire Market Overview:

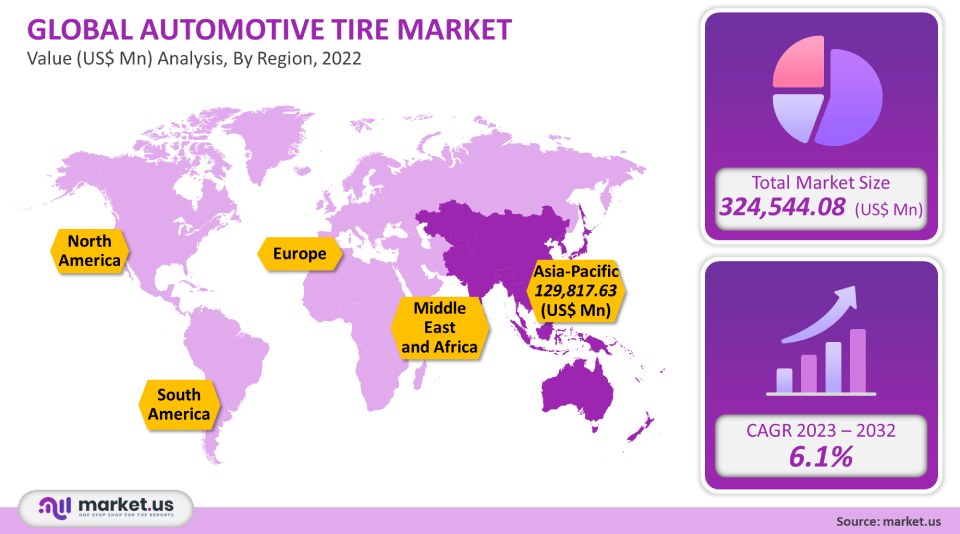

The Automotive Tire Market size is expected to be worth around USD 622.23 billion by 2032 from USD 324.5 billion in 2021, growing at a CAGR of 6.1% during the forecast period from 2022 to 2032.

Over the forecast period, technological advances in the automotive industry will drive demand. Because of the competitive nature and high demand for automotive tires, companies continue to innovate in order to differentiate their products. The tread pattern is durable and offers high performance. It can also self-regenerate as it’s used. This means that it can provide excellent grip even when worn.

Global Automotive Tire Market:

Type Analysis

The dominant segment of radial tires was the radial tire in 2021. It accounted for 75% and more of the total revenue that year. Radial tires will dominate the market trends due to their numerous benefits including reduced fuel consumption, ground compaction, and damage, and greater productivity.

The segment growth is likely to be boosted by a shift in radicalization within the bus and truck segments, with global vendors focusing on significant revenue share in countries like India.

Application Analysis

The automotive tire industry was dominated by passenger cars (PC), which accounted for more than 40% of total revenue. The economic environment that affects passenger car sales is highly dependent on fluctuations in exchange rates and GDP growth. Demand for passenger cars is also affected by volatile fuel prices, transportation infrastructure, and other factors. Due to the improved economic outlook in the U.S. as well as developing markets like China, India, and India, the worldwide demand for PCs is expected to grow.

With over 20% of 2021 revenue, the Light Commercial Vehicle segment (LCV), holds a significant share. LCVs are lower in maintenance and operating costs, as well as more fuel-efficient than Heavy Commercial Vehicles (HCV).

The economic slowdown caused a slowdown in heavy and medium commercial vehicle sales. Rural demand for light commercial vehicles is growing in India, which is Asia’s largest automotive market.

Key Market Segments:

Passenger car segments are given below,

Application

- Passenger cars

- LCV

- HCV

- Two-wheelers

Tire Type

- Radial

- Bias

Market Dynamics:

It is expected that increasing demand for passenger cars and commercial vehicle sales will drive tire consumption in the future. OICA, the International Organization of Motor Vehicle Manufacturers reports that over 90 million passenger and commercial cars were built in 2015. Around 19% of all global production was produced in Europe. This led to an increase in automotive tires.

Manufacturers of tires are keener to develop sustainable tires that can be both economically viable and that meet strict performance standards. Lehigh Technologies’ Micronized Rubber Powder is an example of a low-cost, sustainable and customizable feedstock that can be used to manufacture over 300 million tires.

Manufacturers are expected to increase their use of low rolling resistance (LRR), self-inflating technology, and fuel efficiency to drive demand. LRR tires decrease rolling effort and save energy. All tire manufacturers are now using LRR tires to improve their fuel economy.

Automotive tire vendors who compete for original equipment fitments strive to improve Corporate Average Fuel Efficiency (CAFE) and reach the federally mandated 54.5 mpg by 2025.

The growth in manufacturing and production capacity of automobiles, as well as the rising demand for passenger vehicles worldwide, drives this market trend. OICA reports that approximately 80 million new passenger vehicle segments and commercial vehicles were produced in 2021. The CAGR was 3% higher than the previous year. Market growth is expected to be driven by an increase in vehicle longevity and passenger safety-related concerns. The low rolling resistance range of tires will be more in demand due to strict regulations from governments.In order to increase productivity and meet increasing demand, major market players are switching to automatic tire manufacturing to improve efficiency. The projection period will see a positive impact on the largest market share due to the increased use of alloys and carbon fiber in tire production. Market growth will be driven primarily by the preference of younger generations for environmentally-friendly tires and production cost reduction.

There are many opportunities for market expansion due to the increasing adoption of EVs, and advancements in technology. Existing players have invested heavily in research and development to develop lightweight tires that can be used with electric vehicles. According to the IEA by 2021, there would be approximately 16.5 million EVs in the world, representing 10% of all cars sold. However, the market is likely to face difficulties due to an increase in the remolding and volatile prices of raw materials and raw material suppliers.

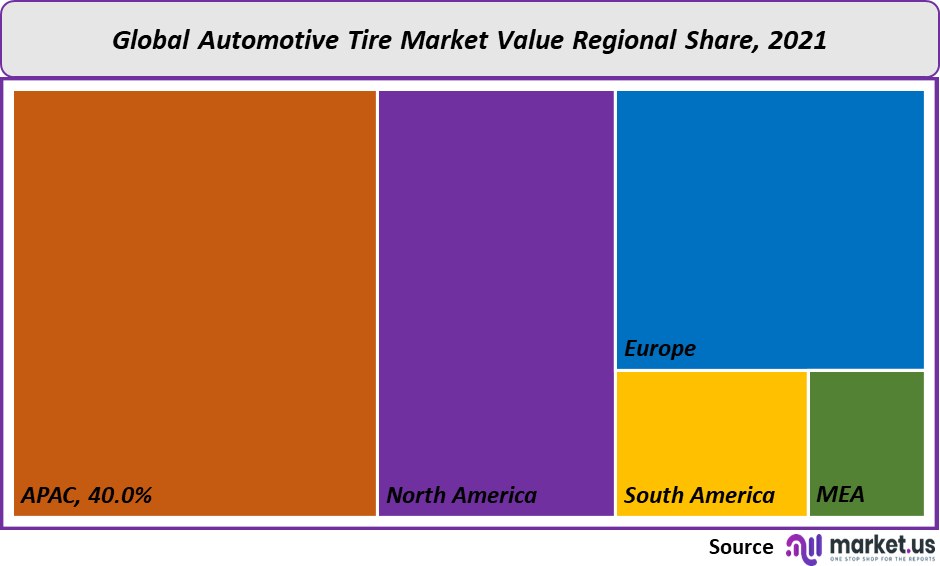

Regional Analysis:

Asia-Pacific automotive tire market accounted for 40% of the global market in 2021 and is expected to grow at a CAGR of over 6% from 2023-2032. The region’s growth will be driven by emerging economies like India, China, and Brazil over the forecast period. These emerging economies are expected to contribute to the future growth of the global economy by boosting domestic consumption, improving standards, cheap labor, large populations, and rapidly evolving standards. India is the fastest-growing market in LCVs and passenger cars, owing to growing demand from the rural sector.

Europe is projected to grow at a rate of 6.5% from 2023-2032. New car sales are expected to be driven by strong demand in the European Union’s major markets. Renault SA, a French manufacturer of cars, is one of the leading brands in this sector. Europe’s sales of sport-utility cars continue to rise.

Key Regions and Countries covered іn thе rероrt:

Here are some of the regional players in the market for automotive tires:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

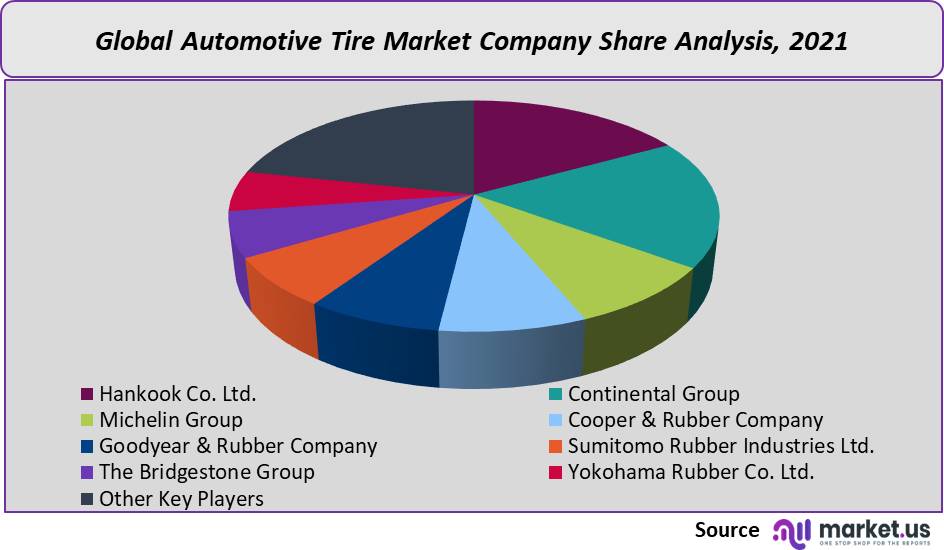

Market Share Analysis:

As the industry thrives on product shows and new launches, participants seek to expand their customer base by increasing investment in R&D.

Hankook Co. Ltd. announced in March 2022 that the company would launch iON, which is a specially-designed high-quality tire for the premium electric vehicle type. It will deliver high performance and maximize the efficiency of EVs. Hankook Co. Ltd. is now focusing on the increasing demand for EVs as well as the need to have the right tires to replace them.

In June 2021 the Goodyear Tire & Rubber Company bought Cooper Tire & Rubber Company. The merger unites two of the world’s most respected premium quality tire companies. It combines its portfolios, add-value services, and capabilities to make a stronger global tire leader headquartered in the United States. The resultant company is expected to offer more options across all value spectrums.

The Yokohama Rubber Co. Ltd. created a technology to detect tire wear in April 2021. This technology alerts vehicle owners or fleet managers to replace tires that are damaged. This improves additional safety and reduces tire costs.

Key Market Players:

Here are some of the major players in the market for automotive tires:

- Hankook Co. Ltd.

- Continental Group

- Michelin Group

- Cooper & Rubber Company

- Goodyear & Rubber Company

- Sumitomo Rubber Industries Ltd.

- The Bridgestone Corp.

- Yokohama Rubber Co. Ltd.

- Apollo Tires

- Other Key Players

For the Automotive Tire Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 324.5 bn

Growth Rate

6.1%

Forecast Value in 2032

USD 622.23 bn

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Whаt іѕ thе ѕіzе оf thе Аutоmоtіvе Тіrе mаrkеt іn 2021?Тhе Аutоmоtіvе Тіrе mаrkеt ѕіzе wаѕ UЅ$ 324,544.08 mіllіоn іn 2021.

Whаt іѕ thе рrојесtеd САGR аt whісh thе Аutоmоtіvе Тіrе mаrkеt іѕ ехресtеd tо grоw аt?Тhе Аutоmоtіvе Тіrе mаrkеt іѕ ехресtеd tо grоw аt а САGR оf 6.1% (2023-2032).

Lіѕt thе ѕеgmеntѕ еnсоmраѕѕеd іn thіѕ rероrt оn thе Аutоmоtіvе Тіrе mаrkеt?Маrkеt.UЅ hаѕ ѕеgmеntеd thе Аutоmоtіvе Тіrе mаrkеt bу gеоgrарhіс (North America, Еurоре, АРАС, Ѕоuth Аmеrіса, аnd Міddlе Еаѕt аnd Аfrіса). Ву Аррlісаtіоn, mаrkеt hаѕ bееn ѕеgmеntеd іntо Раѕѕеngеr саrѕ, LСV, НСV, аnd Тwо-whееlеrѕ. Ву Тіrе Туре, thе mаrkеt hаѕ bееn furthеr dіvіdеd іntо Rаdіаl аnd Віаѕ.

Lіѕt thе kеу іnduѕtrу рlауеrѕ оf thе Аutоmоtіvе Тіrе mаrkеt?Наnkооk Со. Ltd., Соntіnеntаl Grоuр, Місhеlіn Grоuр, Соореr & Rubbеr Соmраnу, Gооdуеаr & Rubbеr Соmраnу, Ѕumіtоmо Rubbеr Іnduѕtrіеѕ Ltd., Тhе Вrіdgеѕtоnе Grоuр, Yоkоhаmа Rubbеr Со. Ltd., аnd Оthеr Кеу Рlауеrѕ еngаgеd іn thе Аutоmоtіvе Тіrе mаrkеt.

Whісh rеgіоn іѕ mоrе арреаlіng fоr vеndоrѕ еmрlоуеd іn thе Аutоmоtіvе Тіrе mаrkеt?Аѕіа-Расіfіс іѕ ассоuntеd fоr thе hіghеѕt rеvеnuе ѕhаrе оf 40%. Тhеrеfоrе, thе Аutоmоtіvе Тіrе іnduѕtrу іn Аѕіа-Расіfіс іѕ ехресtеd tо gаrnеr ѕіgnіfісаnt buѕіnеѕѕ орроrtunіtіеѕ оvеr thе fоrесаѕt реrіоd.

Nаmе thе kеу аrеаѕ оf buѕіnеѕѕ fоr Аutоmоtіvе Тіrе?Ѕоuth Коrеа, Сhіnа, Іndіа, Јараn, Gеrmаnу & Тhе UЅ, аrе kеу аrеаѕ оf ореrаtіоn fоr Аutоmоtіvе Тіrе Маrkеt.

Whісh ѕеgmеnt ассоuntѕ fоr thе grеаtеѕt mаrkеt ѕhаrе іn thе Аutоmоtіvе Тіrе іnduѕtrу?Wіth rеѕресt tо thе Аutоmоtіvе Тіrе іnduѕtrу, vеndоrѕ саn ехресt tо lеvеrаgе grеаtеr рrоѕресtіvе buѕіnеѕѕ орроrtunіtіеѕ thrоugh thе rаdіаl tіrеѕ ѕеgmеnt, аѕ thіѕ аrеа оf іntеrеѕt ассоuntѕ fоr thе lаrgеѕt mаrkеt ѕhаrе.

![Automotive Tire Market Automotive Tire Market]()

- Hankook Co. Ltd.

- Continental Group

- Michelin Group

- Cooper & Rubber Company

- Goodyear & Rubber Company

- Sumitomo Rubber Industries Ltd.

- The Bridgestone Corp.

- Yokohama Rubber Co. Ltd.

- Apollo Tires

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |